Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

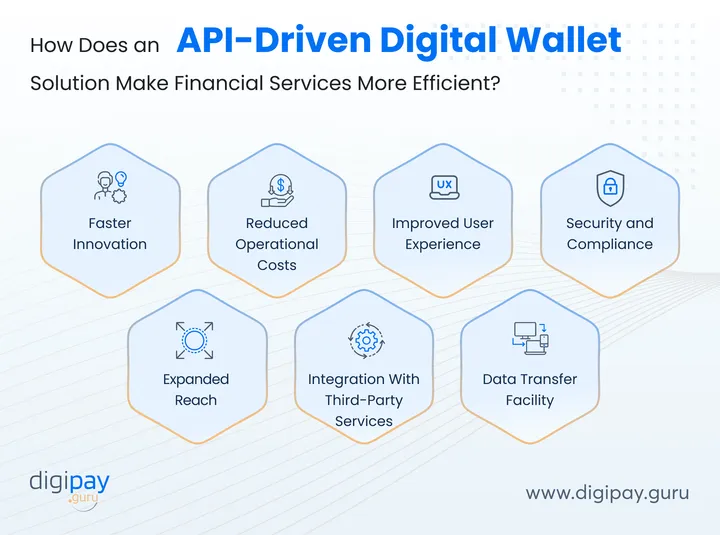

Your Wallet Just Got Smarter: The Rise of Digital Wallet Integrations

Unlock the future of finance! Discover how digital wallet integrations are revolutionizing your spending experience. Don’t miss out!

How Digital Wallet Integrations Are Revolutionizing Online Shopping

The rise of digital wallets has significantly transformed the online shopping landscape, offering a seamless and efficient payment solution for consumers. With the integration of popular digital wallets like PayPal, Apple Pay, and Google Pay, shoppers can now complete transactions in just a few clicks. This convenience not only enhances user experience but also leads to higher conversion rates for e-commerce businesses. According to recent studies, businesses that adopted digital wallet integrations saw an increase in sales by up to 30%, showcasing the profound impact these technologies have on enhancing customer satisfaction.

Moreover, digital wallet integrations contribute to improved security and fraud protection, making online shopping safer for consumers. By using tokenization and end-to-end encryption, these wallets prevent sensitive information from being exposed to potential threats. Additionally, digital wallets often provide instant access to receipts and spending analytics, empowering consumers to manage their finances more effectively. As online shopping continues to evolve, the adoption of digital wallets will undoubtedly play a crucial role in shaping a more secure and user-friendly shopping experience.

Counter-Strike is a popular tactical first-person shooter game that has captivated millions of players worldwide. It focuses on team-based gameplay, where players can choose to be either terrorists or counter-terrorists, each with unique objectives. If you're looking to enhance your gaming experience, you might want to check out the betpanda promo code for some exciting offers.

The Future of Payment: Why You Should Embrace Digital Wallets

As we move towards a more digital-centric world, the future of payment is increasingly dominated by innovations in technology. Digital wallets are at the forefront of this shift, providing users with a convenient and secure way to manage their finances. Unlike traditional wallets, digital wallets store your payment information in a virtual format, allowing for quick transactions with just a click or tap. This seamless process has made it easier for consumers to shop online and in-store, reducing the hassle of carrying cash or multiple cards.

Adopting digital wallets not only enhances user experience but also offers various benefits that are hard to ignore. For instance, many digital wallet platforms come with added security features like encryption and two-factor authentication, significantly reducing the risk of fraud. Moreover, users benefit from tracking their spending habits through in-app features, promoting better financial management. As the trend continues to grow, both consumers and businesses would be wise to embrace this future of payment, ensuring they remain competitive and responsive to the evolving market demands.

What You Need to Know About Security With Digital Wallet Integrations

As digital wallets become increasingly popular, understanding the security measures associated with digital wallet integrations is paramount. Digital wallets allow users to store and manage their payment information securely on their devices, making transactions quicker and more convenient. However, this convenience comes with potential risks, such as data breaches and identity theft. To mitigate these risks, it is essential to ensure that your chosen digital wallet employs robust encryption methods and adheres to industry standards, such as PCI DSS compliance, which helps protect sensitive payment information during transactions.

Moreover, when integrating digital wallets into your website or application, consider implementing additional security features like two-factor authentication (2FA) and transaction monitoring. These measures provide an additional layer of protection by requiring users to verify their identity before completing a transaction. Additionally, keeping your software up to date and regularly testing your systems for vulnerabilities can significantly reduce the chances of a security breach. By prioritizing these security practices, businesses can not only protect their customers' data but also build trust and credibility in the ever-evolving landscape of digital wallet integrations.