Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

Navigating the Thin Line: Skinning Trade Risk Management Strategies You Can't Ignore

Discover vital skinning trade risk management strategies that could make or break your investing journey. Don’t miss these essential tips!

Understanding Skinning Trade Risks: Key Strategies for Effective Management

Understanding the skinning trade risks is crucial for anyone engaged in this challenging industry. The first step in managing these risks is conducting a comprehensive market analysis that includes identifying potential market fluctuations and competition. By closely monitoring industry trends and customer demands, traders can better anticipate changes that may impact their operations. Moreover, implementing risk assessment tools can provide insights into financial liabilities and operational risks, allowing traders to make informed decisions.

Once risks are identified, effective management strategies should be put in place. One effective approach is to diversify your trading portfolio, which can mitigate the impact of negative fluctuations in specific market segments. Another key strategy involves setting clear risk tolerance levels that dictate the parameters of your trading activities. Additionally, consider employing stop-loss orders and other financial instruments to limit potential losses. By combining these strategies, traders can foster resilience and adaptability in an unpredictable market.

Counter-Strike is a highly competitive first-person shooter that has captivated gamers since its inception. Players can engage in various game modes, and strategies often revolve around teamwork and skill. For those looking to improve their trading strategies within the game, a comprehensive trade reversal guide can provide valuable insights.

What Are the Top Trade Risk Management Techniques in Skinning?

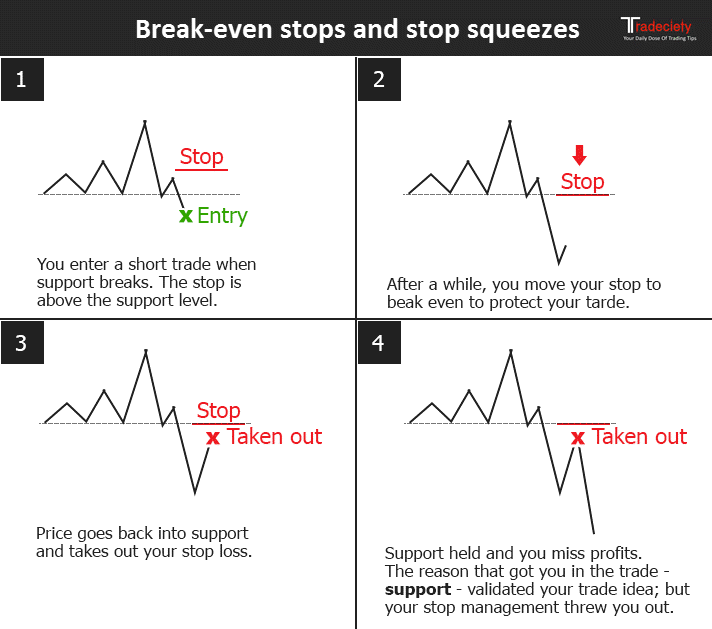

Trade risk management in skinning is essential for minimizing potential losses and maximizing profits in the competitive world of trading. One of the top techniques involves diversification, which means spreading your investments across various assets to reduce exposure to any single asset or market. By diversifying your portfolio, you can mitigate the impact of adverse movements in any one direction. Another vital technique is the use of stop-loss orders. These are automatic orders placed with a broker to sell an asset when its price drops to a certain level, ensuring that losses are capped and protecting your capital.

Additionally, implementing a well-defined risk-reward ratio is crucial for success in risk management. Traders should aim for ratios that favor higher potential rewards compared to the risks taken, typically targeting a 2:1 or 3:1 ratio. Another effective strategy is the use of position sizing, which involves determining the amount of capital to allocate to each trade based on your risk tolerance and account size. By controlling how much you invest in each trade, you can protect your overall portfolio from significant losses while still allowing for growth.

How to Implement an Effective Risk Management Framework in Your Trading Strategy

Implementing an effective risk management framework in your trading strategy is crucial for safeguarding your investments and maximizing returns. First, it's essential to identify the types of risks associated with your trading activities. These may include market risk, credit risk, liquidity risk, and operational risk. Once you have a clear understanding of these risks, you can begin to implement strategies to mitigate them. For instance, setting a maximum loss limit per trade can help prevent significant financial setbacks, ensuring you can continue trading even after a series of losses.

Next, evaluation and continuous monitoring are key components of your risk management framework. Create a structured approach by regularly reviewing your trading performance and adjusting your strategies accordingly. Utilize tools such as stop-loss orders and position sizing techniques to maintain control over your exposure. Additionally, consider documenting your trades and review them periodically. This will not only help you refine your trading strategies but also allow you to learn from past mistakes, ultimately enhancing the resilience of your trading approach.