Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

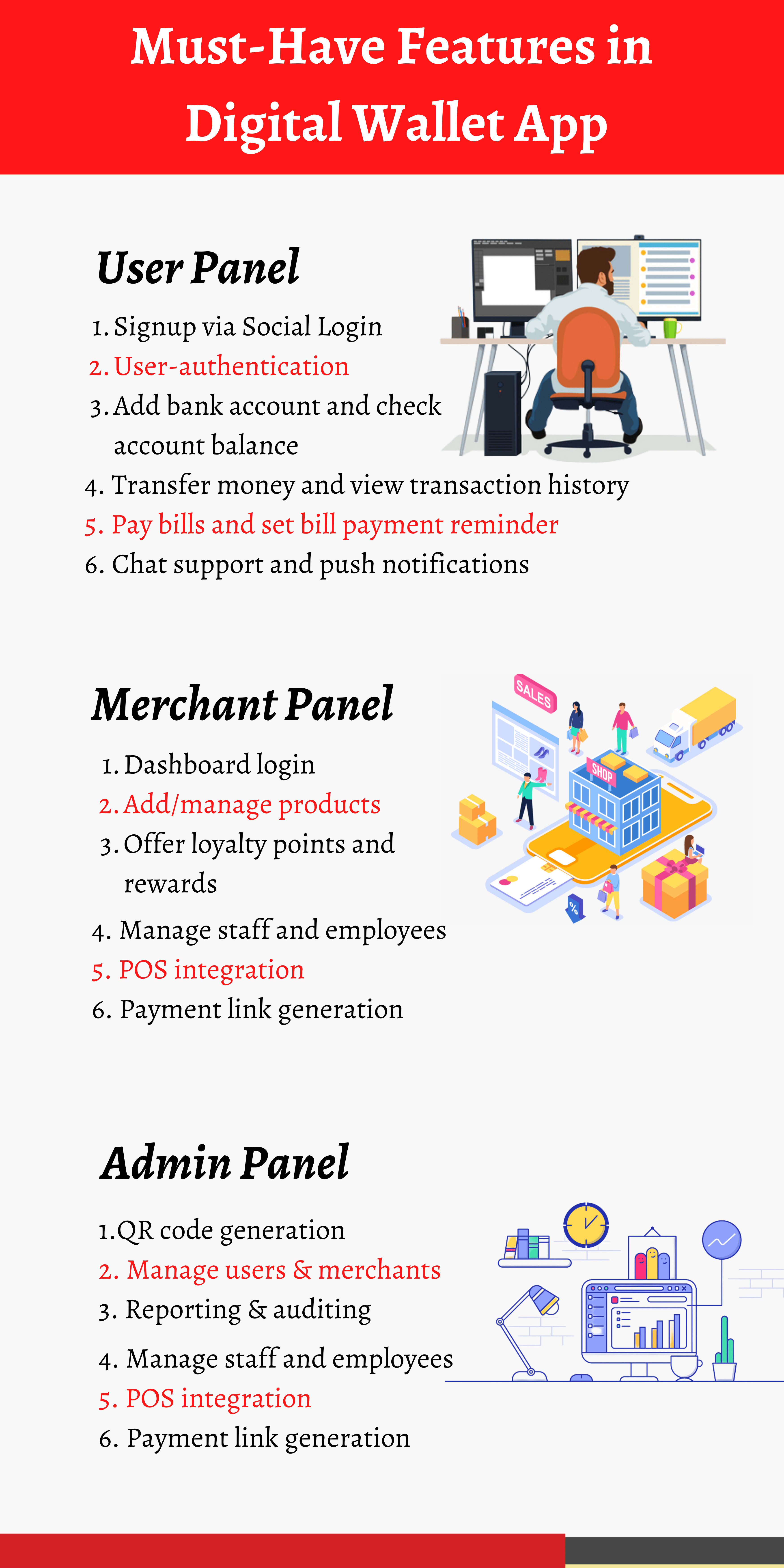

Digital Wallet Integrations: The Future of Seamless Transactions

Discover how digital wallet integrations are revolutionizing transactions. Embrace the future of seamless payments and stay ahead in the digital age!

Exploring the Benefits of Digital Wallet Integrations for Businesses

The rise of digital wallet integrations has brought about a significant shift in how businesses handle transactions. By incorporating digital wallet solutions, companies can enhance their customer experience through faster and more secure payment methods. As consumers increasingly prefer the convenience of mobile and contactless payments, integrating these solutions can lead to increased sales. Businesses that adopt digital wallet integrations can also benefit from reduced transaction costs and improved cash flow management, as these platforms often come with lower fees compared to traditional payment processing methods.

Furthermore, digital wallet integrations offer valuable insights into consumer behavior, enabling businesses to tailor their marketing strategies effectively. By analyzing transaction data, companies can identify trends and preferences, allowing them to craft personalized promotions and improve customer retention. Additionally, the integration of loyalty programs within digital wallets can encourage repeat purchases, enhancing customer engagement and brand loyalty. As the demand for seamless and efficient payment experiences continues to grow, businesses that embrace digital wallet integrations position themselves for a competitive advantage in the marketplace.

Counter-Strike is a highly popular tactical first-person shooter game that has developed a massive following since its release. Players compete in teams, taking on the roles of terrorists or counter-terrorists, with the objective of completing various missions. Many fans enjoy not only playing the game but also engaging in betting on matches, often using sites that offer exciting deals, such as the betpanda promo code, to maximize their experience.

How Digital Wallets are Revolutionizing Consumer Payment Experiences

The advent of digital wallets has significantly transformed the landscape of consumer payment experiences. By offering a seamless and convenient way to conduct transactions, digital wallets eliminate the need for physical cash and even traditional credit cards. Services such as Apple Pay, Google Wallet, and PayPal have become household names, allowing users to store multiple payment methods in one secure location. With features like one-touch payments, consumers can complete purchases in seconds, reducing checkout times and enhancing the overall shopping experience.

Moreover, digital wallets provide an array of benefits that cater to the modern consumer's expectations. Enhanced security features, such as biometrics and tokenization, protect sensitive financial data, instilling confidence in users. Additionally, digital wallets often come with loyalty programs and promotional offers that reward users for their transactions, further incentivizing digital adoption. As businesses and consumers increasingly favor these technologies, it's clear that digtal wallets are not just a trend, but a revolutionary shift in how we perceive and engage with payment systems.

What You Need to Know About Implementing Digital Wallet Solutions

In today's rapidly evolving digital landscape, implementing digital wallet solutions is crucial for businesses aiming to enhance customer convenience and streamline transactions. Digital wallets allow users to store payment information securely on their devices, enabling quick and easy payments without the need for traditional cash or cards. As a business owner, it is essential to understand the technological infrastructure required for integrating these solutions, including secure payment gateways, compliance with financial regulations, and user-friendly interfaces that encourage customer adoption.

When considering the adoption of digital wallet solutions, businesses should evaluate the different options available, such as proprietary wallets, third-party platforms, and cryptocurrency wallets. Additionally, focusing on user education about the benefits, such as faster checkout processes and enhanced security, can significantly boost user acceptance. To successfully implement a digital wallet solution, companies must also invest in robust marketing strategies and continuously analyze user feedback to adapt to evolving market trends and customer preferences.