Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

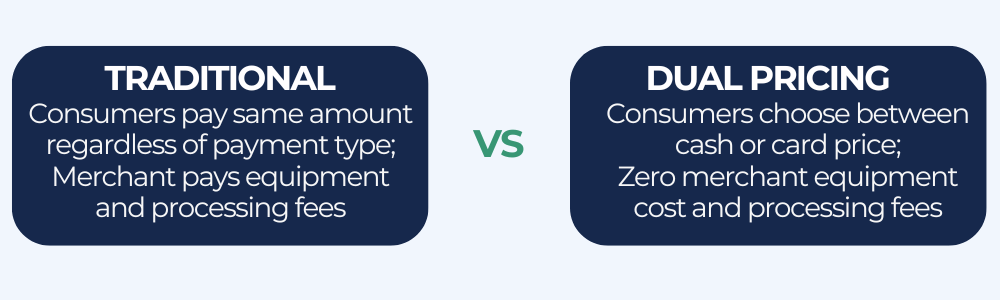

Dueling Payment Methods: A Clash for Consumer Convenience

Discover the battle of payment methods shaping your shopping experience. Which one reigns supreme for convenience? Find out now!

Exploring the Pros and Cons of Digital Wallets vs. Traditional Credit Cards

As we embrace the digital age, the debate between digital wallets and traditional credit cards has gained momentum. Digital wallets, such as Apple Pay and Google Wallet, offer a range of advantages, including enhanced security features like tokenization and biometric authentication. Users can easily make purchases with just a tap of their smartphone, which streamlines the payment process and reduces the risk of card theft. Additionally, many digital wallets support loyalty cards and coupons, making it easier for consumers to save money and access rewards.

However, there are notable disadvantages to consider when opting for digital wallets over traditional credit cards. For instance, not all merchants accept digital wallet payments, and reliance on technology means that users may face difficulties during system outages or battery failures. Furthermore, some individuals may feel uneasy about storing sensitive financial information on their devices, fearing potential hacking or cyber breaches. Traditional credit cards, on the other hand, remain widely accepted and provide a sense of security through their long-established payment infrastructure.

Counter-Strike is a highly competitive online first-person shooter that pits teams of terrorists against counter-terrorists in objective-based gameplay. Players can engage in various game modes and improve their skills while utilizing tactics and teamwork. For those interested in gaming-related bonuses, check out this Duel Referral Code to enhance your experience.

Is Contactless Payment the Future of Transactions? A Deep Dive

The concept of contactless payment has revolutionized the way consumers engage in transactions. With the rise of NFC (Near Field Communication) technology, users can make quick purchases simply by tapping their smartphones or contactless cards at payment terminals. This method not only speeds up the transaction process but also enhances convenience, reducing the need for cash or physical cards. As more retailers adopt this technology, it becomes clear that contactless payment is not merely a trend but a fundamental shift in consumer behavior, leading many experts to argue that it may be the future of transactions.

Moreover, the COVID-19 pandemic has significantly accelerated the shift towards contactless payment systems as health and safety concerns prompted consumers to seek alternatives that minimize physical contact. As society adapts to new norms, businesses that embrace these technologies stand to gain a competitive edge. The incremental benefits, from decreased transaction times to enhanced security, further solidify the idea that contactless payment could dominate the transactional landscape in the years to come. In conclusion, as adoption rates rise and technological advancements continue, we may very well be witnessing the dawn of a new era in consumer transactions.

How Payment Methods Impact Consumer Behavior: What You Need to Know

In today's digital landscape, understanding how payment methods impact consumer behavior is crucial for businesses looking to optimize their sales strategies. Studies show that a wide range of payment options can significantly influence purchase decisions, as consumers often gravitate towards convenience and security. For instance, offering popular methods like credit cards, digital wallets, and buy-now-pay-later services increases the likelihood of completing a transaction. According to recent surveys, 75% of shoppers abandon their carts due to limited payment options, highlighting the need for businesses to adapt and cater to diverse preferences.

Moreover, the psychological factors associated with various payment methods cannot be ignored. When consumers perceive a payment method as secure and trustworthy, they are more inclined to proceed with their purchases. Cashless payments not only streamline the checkout process but also enhance consumer confidence, as they often provide automatic records and fraud protection. For businesses, recognizing the nuances of how payment options affect consumer behavior can lead to strategic adjustments that not only foster customer loyalty but also drive increased sales and long-term success.