Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

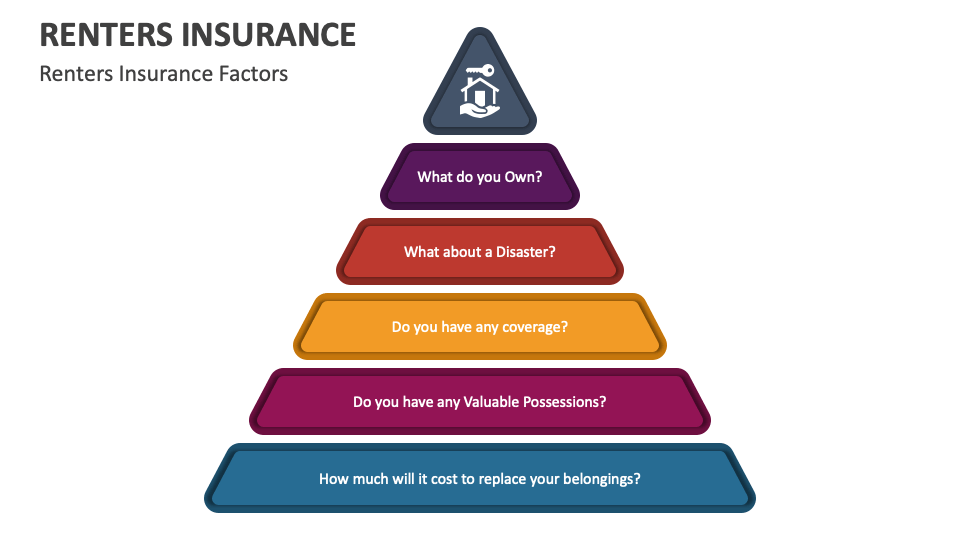

Why Your Landlord's Insurance Isn't Enough

Discover the hidden risks your landlord's insurance won't cover and learn how to protect your investment effectively!

The Hidden Costs of Relying Solely on Landlord's Insurance

While landlord's insurance offers essential coverage for property owners, relying solely on these policies can expose landlords to significant hidden costs. For instance, many landlords overlook additional expenses associated with specific scenarios that standard policies might not cover. This includes natural disasters, tenant disputes, and unexpected repairs, which can lead to substantial financial burdens. According to reports, incidents such as fire damage can result in costs that insurance does not fully cover, leaving landlords to foot the bill. Furthermore, the expenses from legal liabilities can accumulate quickly, especially if the landlord is unprepared.

Additionally, relying exclusively on landlord's insurance can lead to inadequate coverage that can leave landlords vulnerable. For example, many policies have specific limits on coverage, including caps on payouts for tenant-related incidents. If a landlord faces a severe liability issue, such as an injury on the property, the financial repercussions could far exceed the limits set by their insurance policy. This illustrates the critical need for landlords to consider supplemental coverage options alongside their primary insurance. Diversifying their coverage can not only safeguard their investments but also mitigate unexpected financial distress.

What Landlord's Insurance Covers (And What It Doesn't)

Landlord's insurance is specifically designed to protect property owners from various risks associated with renting out their properties. Typically, this type of insurance covers damages to the property caused by events like fire, storms, vandalism, and theft. Additionally, it often includes liability coverage, which protects landlords in the event that a tenant or visitor suffers an injury on the property. For more detailed information about standard coverage options, you can visit Nolo's guide on landlord insurance.

However, landlord's insurance does not cover everything. For instance, it typically excludes coverage for tenant damage unless it results from a covered peril, and it may not cover routine maintenance issues or wear and tear. Additionally, if a tenant fails to pay their rent, this insurance does not provide a safety net for lost income. To understand these exclusions more thoroughly, it may be helpful to check out this article from Policygenius.

Are You Fully Protected? Common Gaps in Landlord's Insurance Policies

When it comes to safeguarding your investment property, landlord's insurance is a crucial consideration. However, many landlords unknowingly leave themselves exposed to certain risks due to common gaps in their insurance policies. One prevalent issue is the lack of coverage for natural disasters, such as floods or earthquakes, which are often not included in standard policies. Additionally, vacancy clauses can pose a significant risk; many policies do not cover properties that are unoccupied for extended periods, leaving landlords vulnerable during times of transition.

Another critical area to evaluate is liability coverage. Landlords may believe they are fully protected, but standard policies might not cover injuries that occur due to **structural issues** or negligence. It's advisable to meticulously review the terms of your policy, especially regarding liability limits and exclusions. Furthermore, consider whether your policy protects against tenant-related damages, which can often be a significant financial burden that standard policies do not address. Ensuring comprehensive coverage requires a thorough understanding of these common gaps and an open dialogue with your insurance provider.