Auscot Gems: Unearthing Australia's Hidden Treasures

Explore the fascinating world of Australian gemstones and the stories behind them.

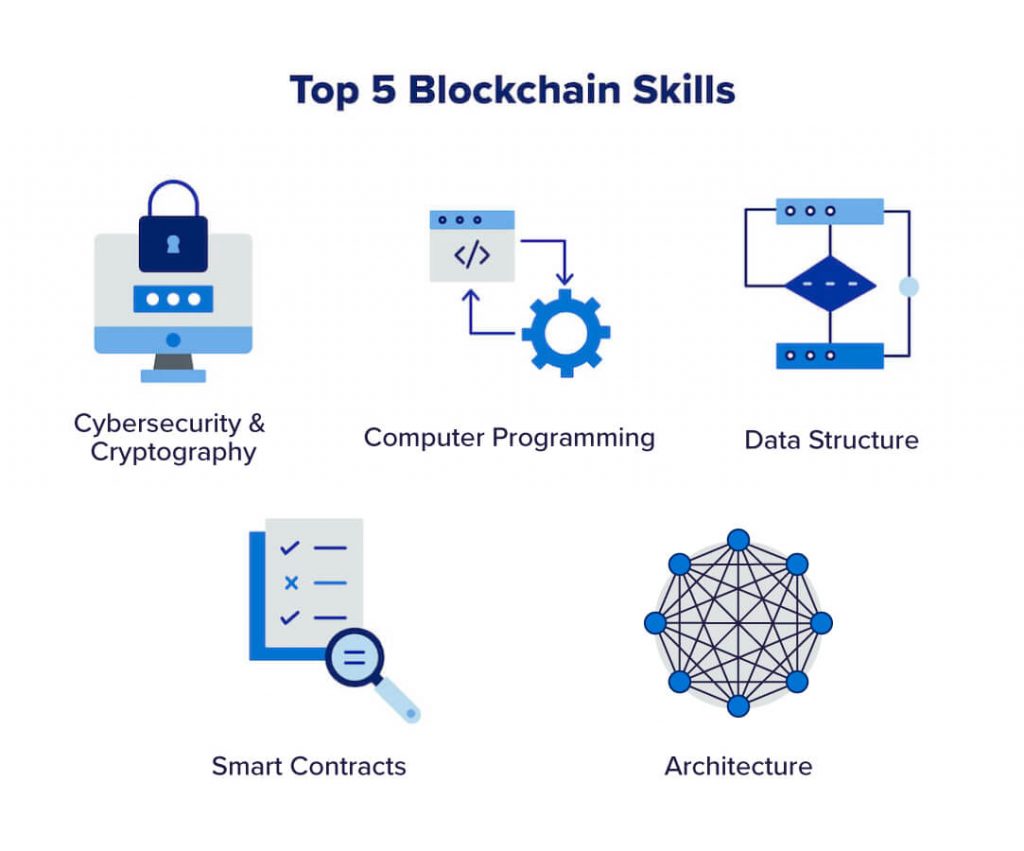

Blockchain Beyond Bitcoin: The Hidden Gems You Didn't Know About

Discover the surprising blockchain innovations beyond Bitcoin that could change the game. Uncover the hidden gems you never knew existed!

Exploring Decentralized Finance: Understanding DeFi Beyond Bitcoin

Decentralized Finance, commonly referred to as DeFi, represents a revolutionary shift in the financial landscape, expanding far beyond Bitcoin. While Bitcoin is often credited as the first cryptocurrency, DeFi encompasses a broader spectrum of blockchain-based financial services that eliminate intermediaries, allowing users to engage in lending, borrowing, and trading directly with one another. This radical approach not only enhances accessibility but also increases transparency, enabling anyone with an internet connection to participate in the global financial ecosystem. The rise of DeFi applications, such as automated market makers (AMMs) and yield farming, highlights the innovative solutions being developed to provide users with better financial tools.

To fully appreciate the implications of DeFi, it's essential to understand its various components. Here are a few key elements that define the DeFi space:

- Smart Contracts: Self-executing contracts with the terms directly written into code, facilitating automated transactions.

- Decentralized Exchanges (DEXs): Platforms that enable peer-to-peer trading of cryptocurrencies without the need for a central authority.

- Lending Protocols: Services like Aave and Compound that allow users to lend and borrow digital assets while earning interest.

As DeFi continues to mature, it is poised to reshape traditional finance by offering more inclusive, efficient, and innovative financial solutions.

The Rise of Non-Fungible Tokens: A Deep Dive into NFTs

The rise of non-fungible tokens (NFTs) has marked a revolutionary shift in the digital landscape, transforming how we perceive ownership and value in the virtual world. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique digital assets that represent ownership of a specific item or piece of content, such as artwork, music, or collectibles. This uniqueness has created a new ecosystem in which artists and creators can monetize their digital works directly, fostering a decentralized marketplace that empowers individuals over corporations.

As we delve deeper into the phenomenon of NFTs, it's essential to understand the technology driving this trend: blockchain. The use of blockchain ensures the authenticity and provenance of digital assets, making it possible for buyers to verify ownership and scarcity. Moreover, the NFT market has seen unprecedented growth, with some digital artworks selling for millions of dollars at auction. This surge in popularity raises important questions about the future of art and collectibles in a digital age. Are NFTs merely a passing trend, or do they represent a fundamental shift in the way we interact with digital content? The answer may shape the industry for years to come.

Blockchain Innovations: How Smart Contracts are Revolutionizing Industries

Blockchain innovations are transforming the way businesses operate, and one of the most significant advancements in this space is the rise of smart contracts. These self-executing contracts with the terms of the agreement directly written into code are automating processes and enhancing trust among parties. Industries ranging from real estate to finance are harnessing the power of smart contracts to reduce the need for intermediaries, increase transparency, and minimize disputes. For instance, in real estate, smart contracts can streamline property transactions by automatically executing the transfer of ownership once specific conditions are met, such as payment completion.

As smart contracts continue to evolve, their potential applications are expanding across various sectors. In supply chain management, these contracts can provide real-time tracking of goods and ensure that parties adhere to their agreements without the need for constant oversight. Furthermore, in the healthcare industry, smart contracts can facilitate secure sharing of patient data between providers while maintaining compliance with privacy regulations. Overall, the integration of blockchain innovations and smart contracts is not just a trend; it is a fundamental shift that is redefining how industries operate in the digital age.